To everything … There is a season

— The Byrds – Turn! Turn! Turn!

Every company has to manage its portfolio of products or projects, as each undergoes its life cycle of birth, growth, decline.

Apple derives the majority of its revenues and profits from just a handful of products: iPhone, iPad, and personal computers. Each of the segments has had its day as a growth driver, and the iPhone is just now showing signs of slowing unit growth.

Their big question is what product line can become the growth driver, given that the phone segment generated over $140B in sales during the last year? (I realize that most Fortune 500 CEOs would love to have such a problem…)

They could of course come up with a new or improved existing product, and dominate the space, as they did with music players, tablets, and smartphones. The Watch is an early attempt at identifying the next market, and it’s doing well relative to other competitors, but not in sufficient volume to be relevant.

The company reportedly considered the TV market, which in some regards helps fill a short-term gap, as TVs are high-ticket item consumer electronics, but competitors seem all too willing to drive prices down on the latest innovations as quickly as possible. Apple could still develop something here, but seem content for now to use their Apple TV box to let them continue working on this segment.

There are only a few other industries with companies that generate revenue of Apple’s magnitude: Oil, Retail, Automotive, and Financial Services.

Only one of those plays to Apple’s core strength of developing cutting edge products for consumers: Oil. Just kidding!

Apple has experience with retail, but I don’t see them wanting to go beyond their high-end niche, and try competing with Wal-Mart or Amazon, purveyors of anything and everything.

The company is making forays into the financial world with Apple Pay, but for now need to leverage other competitor’s infrastructure, and it seems more like incremental efforts to bolster their ecosystem.

That leaves the automotive world. They started integrating their technology as infotainment devices, with Apple Carplay. This is again an incremental play, and enables them to build relationships, and see where they can add value, and play to their strengths.

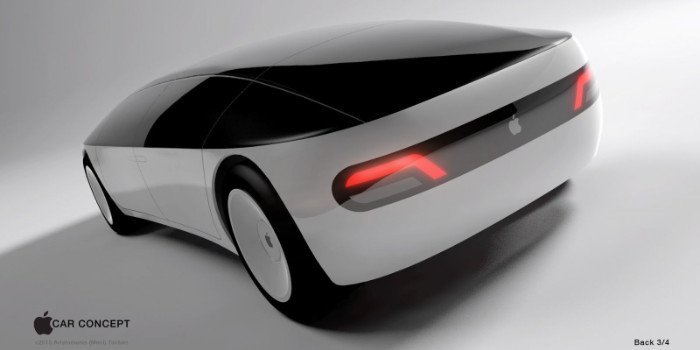

But could Apple expand their forays into cars with an actual car? And would they compete with the BMWs of the world, or with Uber with a self-driving car service? The current rumors suggest they went down the path of having their own car design, but may have shelved it while continuing development of self-driving systems.

Nothing in their past suggests Apple wants to be solely a technology provider to other companies, and it’s unclear what competitive advantage they would have in the self-driving tech space. Pausing the development of the entire vehicle could simply be a pause, while they think through their options, and see the pace of the industry’s evolution from a “car in every driveway” to an “always available taxi service.”

Apple’s strength has always been in providing an integrated hardware/software/service experience, and the only way to achieve that in the auto industry is to develop or acquire their own car design. Others have suggested Apple acquire Tesla to quickly establish a strong position in the industry, but they have never used major acquisitions to enter a product category.

Where does that leave us, or Apple?

Our goal-based planning approach tells us that Apple need a replacement for the iPhone as its main growth driver. Their strategy has always been to have a focused product line, rather than a large collection of products. Together, these tell me that Apple will soon be filling its new spaceship-like headquarters with car designers and engineers.