We have recently developed an introductory course for the Oil & Gas industry in partnership with PetroLessons.

If you influence or make portfolio decisions for your company this course is for you!

Introduction to Portfolio Analysis illustrates the use of “portfolio analysis” to develop and compare alternative strategies that an O&G company might pursue. The examples included throughout the course show how projects and corporate performance measures interact and how the interactions create new opportunities for the corporation. The interactions can be quantified to allow decision-makers to compare alternate strategies and quickly assess the business performance trade-offs they will likely face when they select one strategy over another.

The course covers:

- What is a portfolio?

- Why use portfolios?

- Typical corporate planning approaches

- Portfolio planning

- Ranking approaches

- Rank-and-Cut Example using Excel

- Multi-Factor Scoring Example using Excel

- Integrated Optimization Example using npv10

- Evaluating Portfolios

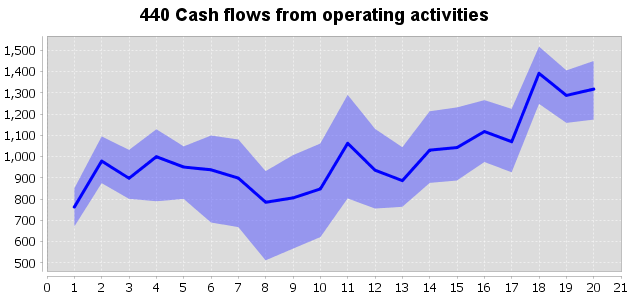

- Creating forecasts

- Using Generic Projects for Developing Strategy

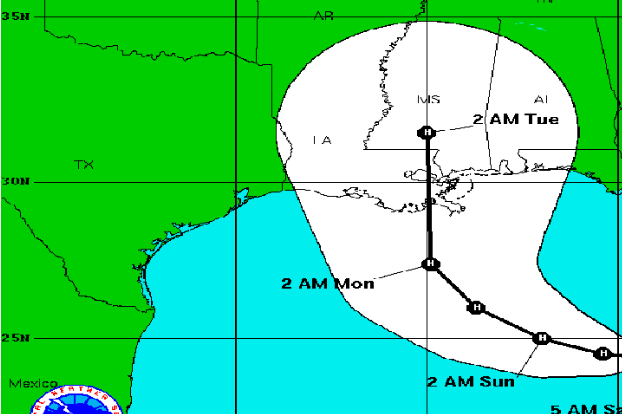

- Uncertainty in Oil & Gas

- The Two-Digit Rule™

- Reducing Uncertainty

- Change Management 101

- Change the Conversation

- Goals and Constraints

- Forecasts

- Uncertainty

Who should take this course:

- Financial Planning & Analysis (FP&A) Executives and Analysts looking for better approaches to corporate planning.

- C-Suite executives needing to take a higher-level view of their company in order to make better strategic decisions and plan ahead for different scenarios.

Benefits/ Course Objectives:

Understand how using a portfolio approach to select projects and analyze different strategies can improve the organization’s performance, and how the culture may need to change to enable a better dialog between the financial planning team and the operating units. You will also see how using multiple forecasts, with probabilities, can enhance your insight into different strategies.